Core Banking Solution: Ever wonder how banks keep track of millions of accounts, handle millions of transactions every day, and make sure everything works behind the scenes? A powerful software program known as a Core Banking Solution (CBS) holds the key to the solution.

Consider CBS as the unseen force behind your bank. It serves as the core nervous system, managing everything from loan processing and customer support to account administration and transactions.

In this article, we’ll look at CBS’s features and advantages, as well as how they affect your banking experience. So, buckle up and prepare to grasp the technology that keeps your funds running smoothly!

What is the Core Banking Solution (CBS)?

Fundamentally, a core banking solution (CBS) is an universal software framework intended to oversee and automation numerous banking functions. It acts as the backbone of a bank’s digital infrastructure, enabling users to access and perform banking operations from any branch or digital platform, independent of the location of their account opening.

Numerous banking operations are managed by CBS systems, such as accounts for deposits, mortgages, loan, payments, and client information management. They guarantee real-time updates, guaranteeing that the balance of a customer’s account and other data are always correct and up to date.

Core Banking Solutions: Importance In Modern Banking

Think of your bank account as a money box. Previously, banks maintained track of these boxes in different rooms, which was inefficient and untidy.

A Core Banking Solution (CBS) functions as a big file cabinet for all of those money boxes. It brings everything together in one safe system. Here’s why CBS is important:

- For you: You may check your money box (account) at any time and from any location by using your phone or computer. No more going to the bank!

- For the bank: They can work quicker and make fewer mistakes. This results in faster service and happy customers (you!).

- For everyone: The bank can simply introduce new services and stay up with the newest technology, making banking even more convenient for everyone.

- Risk Management: CBS systems aid in risk evaluation and fraud detection by offering a full view of client activity, allowing for preventive steps and protecting the bank’s interests.

- Versatile finances: With CBS, banks may provide their consumers financial services at any time and from any location. Customers may conduct banking transactions from any branch or online platform, which increases convenience and accessibility.

- Cost Effectiveness: CBS systems save operational costs by automating numerous human procedures, allowing banks to become more profitable and effective.

Benefits of Core Banking Solutions

Core banking solutions (CBS) operate as a strong engine behind the hood of a modern bank. They provide several benefits for both clients and the bank itself. Here’s the brief rundown:

For customers:

- Banking on the Go: Imagine being able to check your account balance or pay bills from your phone at any time and from anywhere. CBS makes this possible by providing you with 24/7 access to your bank account.

- Faster & Fewer Errors: CBS automates several procedures, resulting in faster transactions and fewer errors. No more standing in line to correct a minor error.

- Convenience is King: CBS makes banking more convenient. You can manage your money from anywhere and complete tasks faster.

For banks:

- Supercharge Efficiency: CBS automates routine activities, freeing up bank employees to assist clients with more complicated requirements.

- Happy clients, Happy Bank: By making banking easier and faster for clients, CBS helps banks develop deeper relationships and retain customers.

- Ready for the Future: Modern CBS are adaptable to new technologies, allowing the bank to stay ahead of the curve.

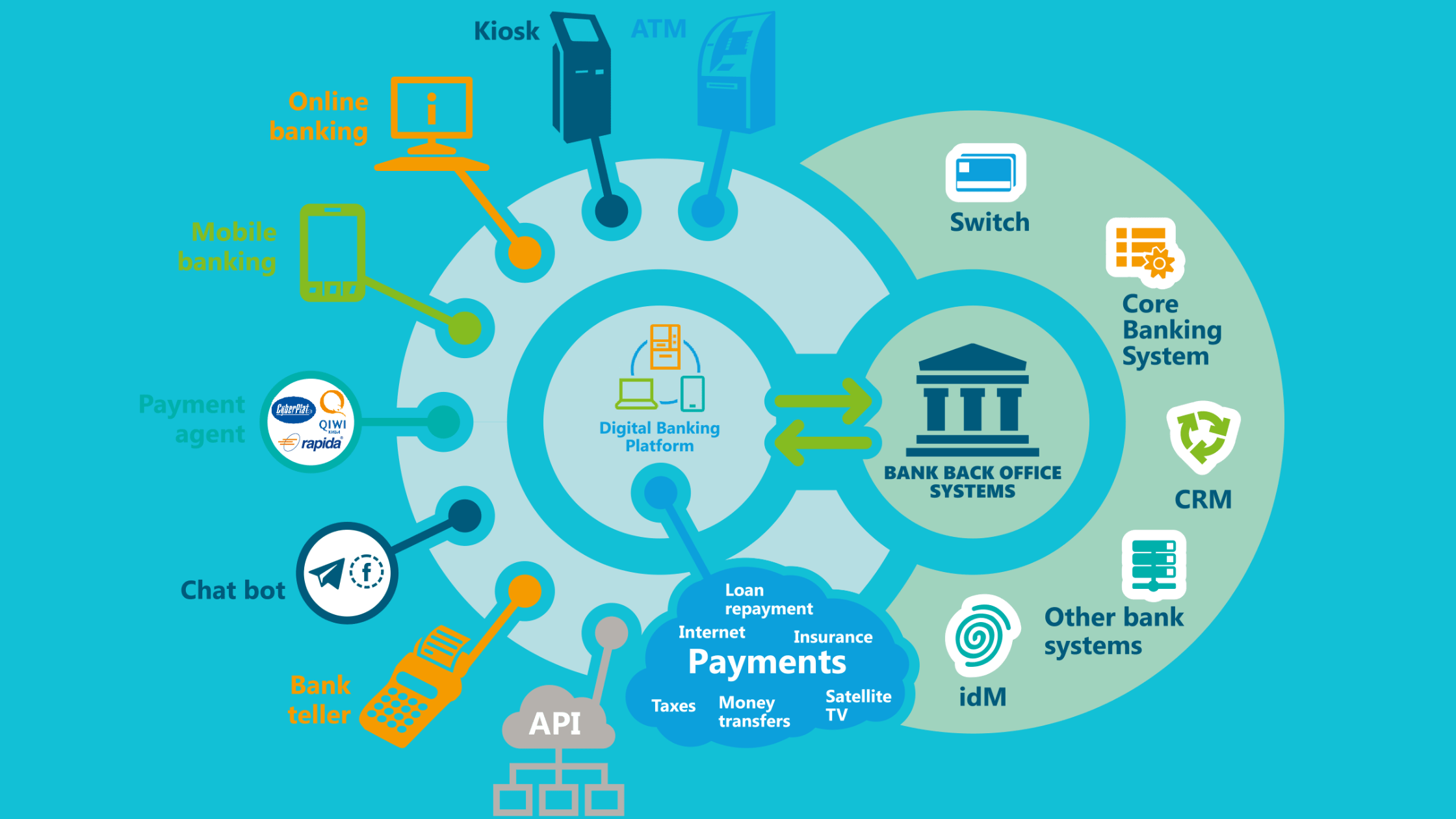

Architecture of Core Banking Solutions

A multi-tiered architecture is commonly used in core banking applications to enable flexibility, efficiency, and privacy. This architectural design consists of:

- Data Layer: This layer acts as the foundation for the safe storage of all bank data, including account, transaction, and customer data.

- Business Logic Layer: The Business Logic Layer includes the fundamental features of the bank system, including transaction processing, account management, and overall banking operations handling.

- Application Layer: This layer provides user interfaces and apps for different financial services and communicates directly through a variety of digital platforms with end users, bank staff, or consumers.

- Integration Layer: This layer ensures smooth integration and data interchange by facilitating connectivity with other systems, including ATMs, payment gateways, mobile banking apps, and more.

For effective and smooth operations, each layer works with each other as needed. Banking institutions can easily adjust to changes and technological improvements thanks to this modular architecture, which enables them to update or modify one layer without impacting the others.

For an effortless and safe banking experience, the CBS architecture makes sure that every component of the system functions as a whole.

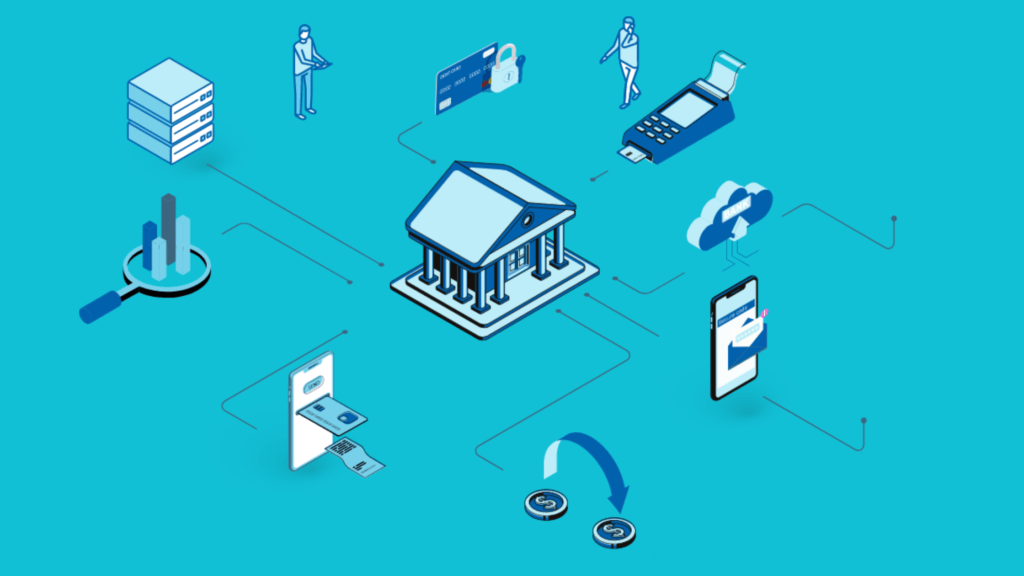

Functions of Core Banking Solutions

Core banking systems use a strong database to hold all client data, account information, history of transactions, and other important information, therefore centralizing and automating banking activities. Every transaction that takes place updates this database instantly.

The CBS handles the transaction when a consumer starts one, whether a deposit, withdrawal, or transfer of funds. Following an identification verification, the system refreshes the customer’s account and changes the balance. In addition, it adds the transaction to the client’s account history simultaneously.

Banking staff may handle client accounts, handle transactions, and offer customer support with the tools provided by the CBS. Their ability to carry out administrative duties, such as processing loan applications or creating new accounts, is enhanced.

As a digital bank’s backbone, CBS essentially streamlines processes and improves consumer and staff convenience with banking.

Features of Core Banking Solutions

Core banking solutions (CBS) are the essentials of modern banking, managing a wide range of functions to keep things operating smoothly. Here’s an overview of several essential functions:

Account Management:

- Open new accounts (savings, checking, loans, etc.)

- Maintaining existing accounts (update details, issue statements)

- Closing accounts

Transaction Processing:

- Processing deposits, withdrawals, transfers, and payments.

- Real-time transaction processing provides fast updates.

- Reconciling accounts for correctness

Loan Management:

- Processing loan applications.

- Calculate interest and manage repayments

- Monitor loan performance and risk.

Customer Management:

- Keeping and maintaining consumer data securely

- Offering customer relationship management (CRM) tools

- Providing multi-channel access (mobile and internet banking)

Other Important Functions:

- Regulatory Compliance: Ensuring the bank follows all financial requirements.

- Security Management: safeguarding consumer information and combating fraud.

- Reporting and analytics: Creating reports on financial performance and customer activities.

These functions work together to provide banks and clients with a robust range of tools. Banks can handle accounts more effectively, minimize mistakes, and provide better services. Customers benefit from speedier transactions, 24-hour access, and an easier banking experience.

Core Banking Solutions: The Future of Banking

With the growth of FinTech (financial technology) and digital banking, CBS is influencing the direction of banking in a big way. A sneak peek at what to expect is as follows:

- Personalized Services: Envision banking solutions made to meet your unique requirements and objectives. Banks can receive the information and resources needed from a CBS to offer customized financial products and advice.

- Enhanced Security Measures: Cyber dangers are evolving along with technology. You can count on CBS systems to constantly improve with more robust security measures to protect your financial information.

- Smooth Integration: The days of juggling several apps for various financial services are coming to an end. By laying the groundwork for smooth interactions with other FinTech products, CBS can provide a more streamlined and practical banking experience.

The Final Word

The next time you easily log in to your mobile banking app or make a speedy transfer at the ATM, remember the quiet hero working behind the scenes: the Core Banking Solution. It is the technology that keeps your bank working efficiently, protects your money, and allows you to manage your accounts with simplicity. As technology advances, CBS will surely play an important part in defining a more efficient, safe, and comfortable future for banking.

For more updates, keep an eye on: www.headlineocean.com